Why you’ll love Versapay:

-

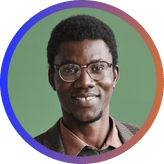

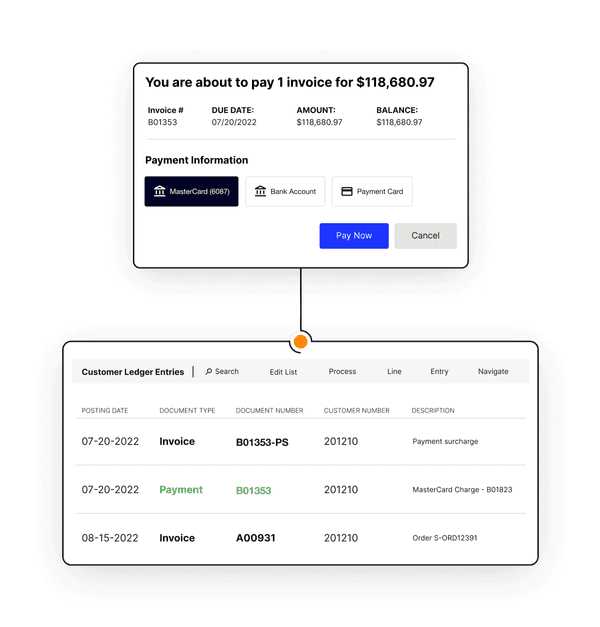

Effortless invoicing, collections, and cash application

-

Real-time visibility across customers, divisions, and countries

-

Integrated collaboration

-

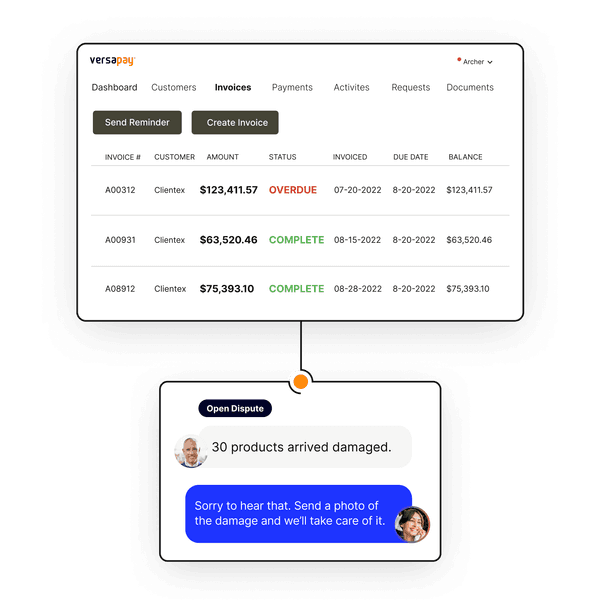

Straight-through payment processing

-

Actionable insights

-

ERP integrations